Salesforce’s Free Suite - the Incumbent’s Dilemma

November 2025 - after years of ceding the entry-level market to “freemium” products like HubSpot and product-led startups like Attio, Salesforce launched the Free Suite.

On the surface, it sounds like Salesforce finally waking up to the low end of the market: a permanently free version of the world’s most powerful CRM. But viewed through the lens of disruptive strategy, this is not a tool for growth - it is a textbook example of the Incumbent’s Dilemma. Salesforce has released a “stripped-down” teaser of its enterprise complexity rather than a purpose-built tool for modern startups and small businesses.

1. The Offering: A “Golden Cage” by Design

The Salesforce Free Suite offers basic Sales, Service, and Marketing tools for $0/forever. However, the constraints reveal its true strategic intent: it is designed to force an upsell, not a platform designed to foster growth.

The Specs vs. The Reality

- The Cap: Strict limit of 2 users.

- The Connectivity: Zero API access. No Mulesoft, no Zapier, no custom integrations.

- The Architecture: No Custom Objects. You are locked into the standard “Lead → Opportunity” flow.

2. The Market Landscape

To understand how weak this offering is, we must look at the competitors. We can categorize them by their market power and strategic intent.

Tier 1: The Established Titan

HubSpot (The Volume Play)

- Market Cap: ~$35B

- The Strategy: “Wide Funnel.” HubSpot gives away unlimited seats to capture the entire company, not just the sales manager.

- The Killer Feature: You can run a 50-person company on HubSpot Free. It creates a network effect inside your organization. Salesforce Free isolates data to just two people, making it a “dead end” rather than a platform.

Tier 2: The Specialist

Pipedrive (The Pure Play)

- Valuation: ~$2-3B (Private Equity)

- The Strategy: “Profit First.” Pipedrive has largely abandoned the “free” market to focus on paid users.

- The Killer Feature: They don’t have a free tier, only trials. However, their $14 entry tier is vastly superior in UX to Salesforce’s free offering. If you are serious about sales, paying Pipedrive is a better investment than fighting with Salesforce’s free limitations.

Tier 3: The Disruptor (The “New Guard”)

Attio (The Innovator)

- Valuation: ~$300M (VC-Backed)

- The Strategy: “Flexible Architecture.” They are building for the “Notion generation” who view CRM as a flexible database.

- The Killer Feature: Attio offers and modern UX AND Custom Objects for free. You can build a “Deal Flow” pipeline or “Candidate Tracker” from scratch. Salesforce Free locks you into rigid “Leads” and “Opportunities,” making it irrelevant for non-traditional business models.

3. The Free CRM Feature Comparison

| Feature | Salesforce Free | HubSpot Free | Pipedrive ($14/mo) | Attio Free |

|---|---|---|---|---|

| Philosophy | ”The Teaser” (Enterprise stripped down) | “The Flywheel” (Volume adoption) | “The Pure Play” (Sales focus) | “The Builder” (Flexible database) |

| User Limit | 2 Users (Hard Stop) | Unlimited (Massive advantage) | N/A (Paid per seat) | 3 Users (Soft Cap) |

| API Access | None (Data Island) | Included (Open API) | Included (Open API) | Included (API-First) |

| Custom Objects | None (Rigid) | None | None (In Entry Plan) | 3 Objects (Fully Flexible) |

| Killer Feature | Brand Prestige | Marketing Tools | Visual UX | Data Modeling |

| Primary Job | ”Look like a big company." | "Organize my contacts." | "Manage my pipeline." | "Build my perfect workflow.” |

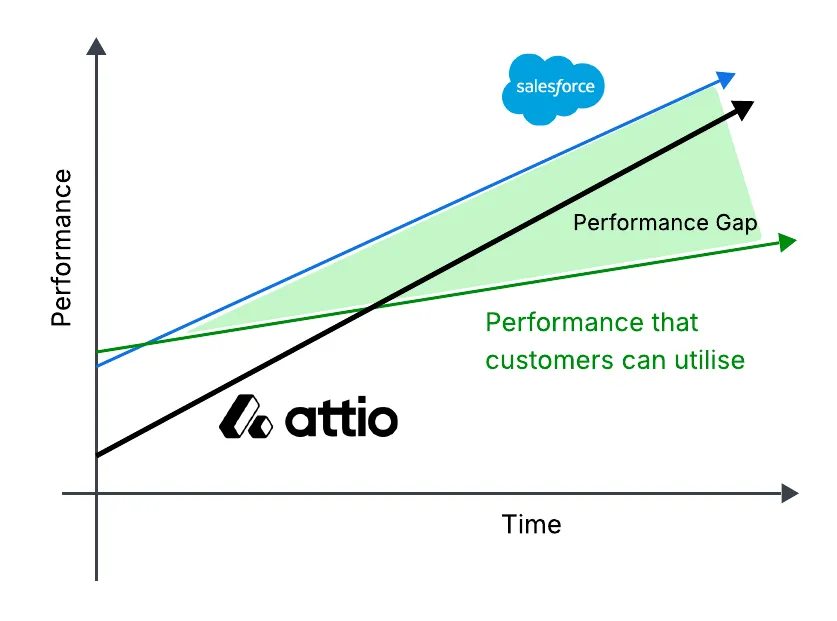

4. The Strategy Diagnosis: The Incumbent’s Dilemma

Why is Salesforce’s offering so weak compared to this diverse field? The answer lies in Cannibalization Fear.

Salesforce cannot make its Free Suite “too good” because it would destroy its own revenue model:

- If they offered API access, small businesses would use the Free Suite + Zapier and never buy the $25/user Starter pack.

- If they offered Custom Objects, consultancies would use the Free Suite instead of the $165/user Enterprise edition.

Result: This is the incumbent’s dilemma - the one that broke Kodak despite them literally inventing the digital camera. They must cripple the product to protect their existing cash cows, resulting in a tool that fails to solve the user’s actual problems.

Attio and HubSpot do not have this fear.

- Attio is pursuing New-Market Disruption, rising from the low end - targeting people who currently use Spreadsheets, not Enterprise software.

- HubSpot views the free tier as a marketing expense (CAC), not a revenue line.

5. The Path Forward: How Salesforce Could Actually Win

If Salesforce wants to stop succumbing to the same fate as Siebel, they must stop playing “defense”. Here are my top 3 paths to fix this:

- Upgrade the Free Suite to “Platform” Suite: Launch a Platform edition as the free suite - The Platform license base (Accounts / Contact standard objects and 10 custom objects) with lightweight marketing, commerce, sales, service. Let customers build their own customizations to get them hooked on the metadata architecture.

- The “Headless” Salesforce: Open the API on the free tier. Accept that Salesforce might just be the “backend database” for a customer’s modern stack.

- The “Acqui-hire” or Clone Strategy: If Salesforce cannot pivot to build a lightweight CRM, they must buy the threat. Acquire Attio or spin up a new startup. Build a CRM from scratch with an AI-first stack. Keep it separate. Do not force it onto the core Salesforce platform backend. Let it run as the “modern entry point” and build a seamless upgrade path to Enterprise Sales Cloud for when companies scale past 50 employees.

Final Verdict

The Salesforce Free Suite is a product of compromise. It tries to be free enough to attract users, but crippled enough to protect enterprise revenue. In doing so, it serves neither master.

- For Scale: Go HubSpot.

- For Customization: Go Attio.

- For Sales Focus: Go Pipedrive (It’s worth the $14).

- For Salesforce Free: Only use this if you are absolutely certain you will migrate to Salesforce Enterprise in 12 months and want to save on data migration costs. Otherwise, it is a trap.

As someone who built a career on this platform, I believe Salesforce is at a critical junction. It must innovate to survive or die the slow death of Siebel.